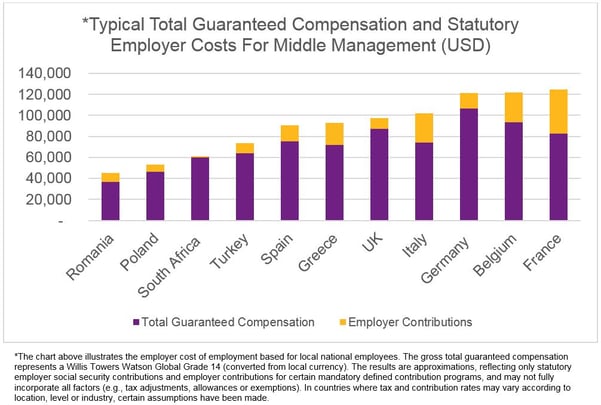

American companies expand overseas for a variety of reasons: proximity to new clients, possibilities to achieve new efficiencies, promises for better support for existing clients. The ultimate drivers are found in countless variables such as sector, business model and maturity, among others. But regardless of the initial reasons, sooner or later, the comparative cost of labor among countries will come up. While questions that usually arise seem simple on the surface, getting to the right answers requires digging into the details and scratching the surface. One particularly influential aspect can be statutory and mandatory costs that employers may be obliged to pay for social security and other employee benefit plans.

GET A FREE "SNEAK PEEK" INTO THE GLOBAL EXPANSION REPORT BUNDLE!

When it comes to American companies expanding overseas and compensation, an employers’ primary focus is generally on what they pay the workforce in order to be competitive yet cost-effective in their quest to attract, retain and engage key talent. For global employers, this invariably leads to the categorization of markets as “high paid”, “low paid” or somewhere in between.

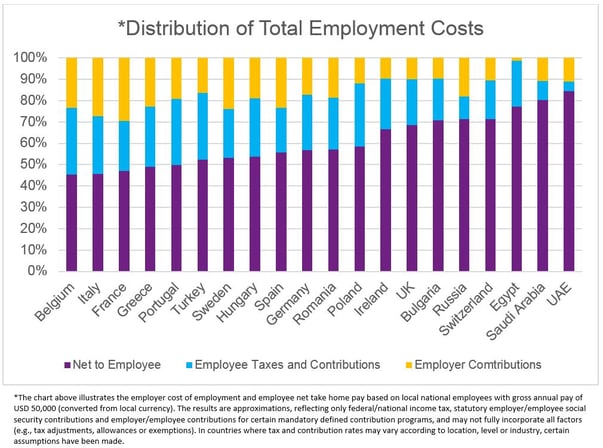

There are also other factors to consider when U.S. companies expand overseas, such as the level of employer costs of statutory employee benefits and the resulting benefits for employees. Where such costs are high, the social welfare net is generally more generous to participants. Where costs are low, benefits are generally less generous.

Across countries, social security and benefit requirements can be as variable as salary costs and heavily influence employer labor costs in many markets.

Significant variation is also seen with the levels of income taxes and statutory contributions paid by employees. While this naturally influences net pay for workers, it also tends to underpin broader reward behaviors across markets. Staff in markets where more pay ends up in their pockets are more likely to focus on their cash compensation. In more extreme cases, where little/no taxes or contributions are payable by employers and employees alike, the market may simply not provide for many reward options besides direct cash.

Where taxes and contribution rates for employers and/or employees alike tend to be high, employers are more likely to look towards the inclusion of non-cash reward vehicles as part of total reward packages. The greater those pressures are, the more likely it is that states provide more tax-efficient alternatives to normal cash compensation. Examples of such alternatives could include the possibility to differ a portion of compensation towards an individual retirement or other savings account on a tax-exempt basis, gain-sharing or the offering of tax-favored fringe benefits among other possibilities. American companies expanding overseas should be aware that while some markets will be rich in possibilities, others will foresee few if any alternatives, essentially handcuffing employer compensation practices.

Is your U.S. company expanding overseas? Learn more about statutory employer costs, compensation practices and social security around the world, click here.

Darryl Davis is a senior consultant with Willis Towers Watson’s Global Research Unit (GRU) which specializes in helping multinational clients understand and leverage the ever-changing facets of compensation, benefits and employment environments around the world. Since 2000, he’s also assisted numerous companies with their reward market intelligence and design needs both in EMEA as well as globally. Prior to joining the GRU, was a senior consultant with Global Data Services for 15 years and was a regular writer and speaker on EMEA reward market trends. Darryl has a Master in Arts degree from the University of Connecticut and is based in Brussels, Belgium.