Like many companies, our annual benefits enrollment period ended in November. As I considered the myriad of benefit choices available to me, I reflected back on my very first enrollment experience. I was fresh out of the Army working for a medical equipment manufacturer in 1998. It was the first time I had to make such a decision, as the Army’s benefit plan was rather straightforward – you were enrolled.

Part 4 in a 7-part series: Evolving the Benefit Mindset

From the need for agility as business-as-usual to the role of organizational purpose (including the attraction and sustainability of human capital through employee wellbeing and inclusion and diversity programs) and much more – these components are essential tools for any leader in today’s climate.

Like many companies, our annual benefits enrollment period ended in November. As I considered the myriad of benefit choices available to me, I reflected back on my very first enrollment experience. I was fresh out of the Army working for a medical equipment manufacturer in 1998. It was the first time I had to make such a decision, as the Army’s benefit plan was rather straightforward – you were enrolled.

With my paper enrollment form and some carrier brochures in hand, I elected a single preferred provider organization (PPO) plan, as opposed to the health maintenance organization (HMO) plan, and enough supplemental life insurance to bury myself should the need arise. Then I licked the stamp (remember that?) and mailed the form to HR. That first experience, with just a bit of choice, felt very empowering – all of a sudden I was an adult!

Fast forward to benefits enrollment today. Paper enrollment forms have been replaced with sophisticated online systems; plan choices have blossomed from PPO versus HMO to flexibly-funded benefits offered by as many as four carriers with upwards of eight plans each, plus a host of voluntary benefits including critical illness, accident, identity theft protection, legal insurance, HRAs, HSAs, FSAs – even pet insurance (more about this later). That feeling of empowerment from having choices may very well devolve to panic or paralysis with the volume of decisions facing employees today.

The broader benefits opportunity

Generational shifts in employee expectations and the changing nature of work necessitate introducing greater choice, flexibility and personalization — enhanced by technology — to provide a meaningful “consumer grade” benefit experience. But some benefits professionals around the country struggle with the conundrum of choice versus confusion and how to present voluntary benefits as an opportunity that employers have to evolve their current offerings.

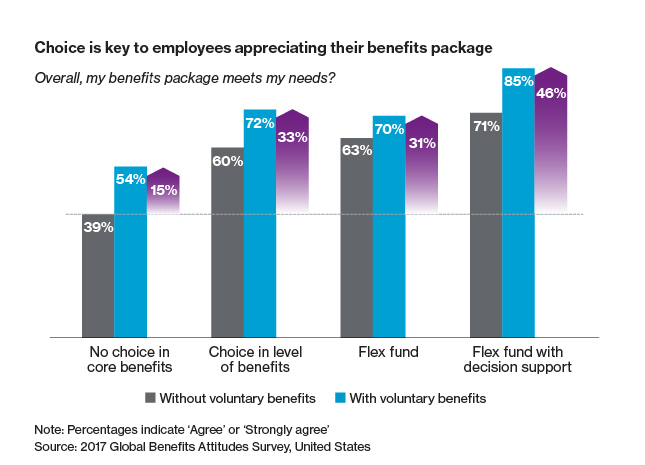

Simply put, employees value choice in benefits. In fact, according to the Willis Towers Watson Global Benefit Attitudes Survey, increasing choice in medical plans significantly increases satisfaction in the Total Rewards package — and including voluntary benefits like those mentioned above as an additional layer of choice further enhances that satisfaction. The survey also found that employees who are satisfied with their benefit plans are twice as likely to be engaged in their jobs. Increasing choice leads to increasing satisfaction, which drives engagement.

Voluntary benefits have a positive impact on satisfaction and engagement

Employers need to recognize that employee appreciation of their total benefit package has a positive impact on employee engagement. Our research shows just over half of employees whose benefit package meets their needs are highly engaged in their job compared to just 25% of employees reporting a high level of engagement when they believe their benefit package does not meet their needs, “ said Julie Stone, a managing director, Health and Benefits, North America, Willis Towers Watson

Additionally, many employers are offering choice in benefits to meet the needs of one of the most diverse workforces in history, according to our Emerging Trends in Voluntary Benefits Survey. The needs of employees in different life stages are vastly different. Take, for example, my needs in 1998 when I was young, single and living with my dog in a one-bedroom apartment. Compare that to my life today: Married with children, a home and two dogs. (Remember pet insurance?)

One challenge employers are trying to solve is the five generations in the workforce, from Traditionals (born before 1946) to Gen Z (born in the late 1990s) – all of whom rely on the same benefit offering to meet their needs. Employers are meeting this challenge by creating choice in medical plans, as well as by adding supplemental or voluntary plans.

Further, there is a shifting mindset to support today’s employees – not just where they are in life today, but where they want to be in the future. Putting employees at the center of the employee/talent experience and recognizing that each has different needs conveys a clear message that “they matter.” For many organizations, this is both a cultural shift and a competitive differentiator.

How are leading organizations putting choice into practice?

So, how do we offer employees enough choice to increase their satisfaction while minimizing the confusion that too much choice can bring? As I experienced in my own benefit enrollment, Willis Towers Watson offers a multitude of tools to help employers strike that balance. For one thing, long before open enrollment began, I started to notice benefits information coming from HR. Emails, posters in the office, postcards at my house, social media announcements, all foreshadowing the annual enrollment experience. These communications led me to an online portal where I found detailed plan information and other educational resources. Immediately before annual enrollment I received the flagship communication piece – a company-branded electronic annual enrollment “booklet” explaining all of my choices, how they worked together and how I could create my own custom-designed benefit program.

Willis Towers Watson’s enrollment site includes the ability to engage a decision support engine to help employees make informed decisions. This tool asks a series of questions to help gauge an employee’s risk tolerance, potential out-of-pocket exposure and attachment to current family physicians. Behind-the-scenes algorithms help guide employees to the plans that are the best fit for them, balancing fixed-dollar premium costs with out-of-pocket risk. Employees who experience this type of benefits enrollment feel empowered and satisfied, knowing they’ve made informed benefit choices for themselves and their families.

The Global Benefit Attitudes Survey also observed that 70% of employees who were offered the maximum level of choice in benefits (a true flex fund plus voluntary benefits) stated they were satisfied with their benefits. However, adding decision support technology to that that same level of choice increased the number of satisfied employees by 15%. This suggests that employers can fully realize the value of choice leading to increased employee satisfaction and engagement when they provide tools to help employees understand and appreciate those choices.

Maximizing positive experiences

Designing a voluntary benefits program is one step employers can take to increase their employees’ satisfaction, capture additional engagement and meet the diverse needs of their employee populations. Wrapping that voluntary benefits strategy into a comprehensive communication program, with a decision support component, will drive maximum value from plans for both employers and employees.

Personally, now that my 2019 benefits enrollment is complete, I can go back to the important decisions, like whether to get the third dog my kids are begging for. If I do, I trust that the decision support tool will lead me to the best options for pet insurance next year, among other things.

This blog was originally published on the Willis Towers Watson Wire, January 18, 2019. This post was adapted from the Willis Towers Watson article, “Evolving the employee benefit mindset and strategy: The future arrived yesterday” by Randall K. Abbott, senior strategist emeritus for Willis Towers Watson’s Health and Benefits practice, John M. Bremen, managing director, Human Capital and Benefits, and Amy DeVylder Levanat, director Human Capital and Benefits.

Blog Contributor

Mark Hebert,Voluntary Benefits Practice Leader

Mark Hebert,Voluntary Benefits Practice Leader